Taxpayers May Foot Entire Bill for Kingstonian

“To the President you say I’m a welfare fraud. You motherfucking right.” — Russell Tyrone Jones, Wu-Tang Clan

February 24, 2021

Kingston, NY – At least 82% of the Kingstonian’s construction cost will be borne by the public, with the heaviest burden falling on Kingston property taxpayers and with smaller amounts shouldered by residents throughout New York State and the entire nation. Taxpayer subsidies could rise to 100% if the developers hold the property long enough.

Background

The Kingstonian is a proposed $55 million market-rate (aka luxury) multi-use project consisting of 143 apartments, boutique hotel, garage and retail space to be built in Kingston by three developers and their unidentified Opportunity Zone investors.

Developers say “incentives” – aka corporate welfare – will fund 60.15% but they take vow of silence on boondoggle’s remainder

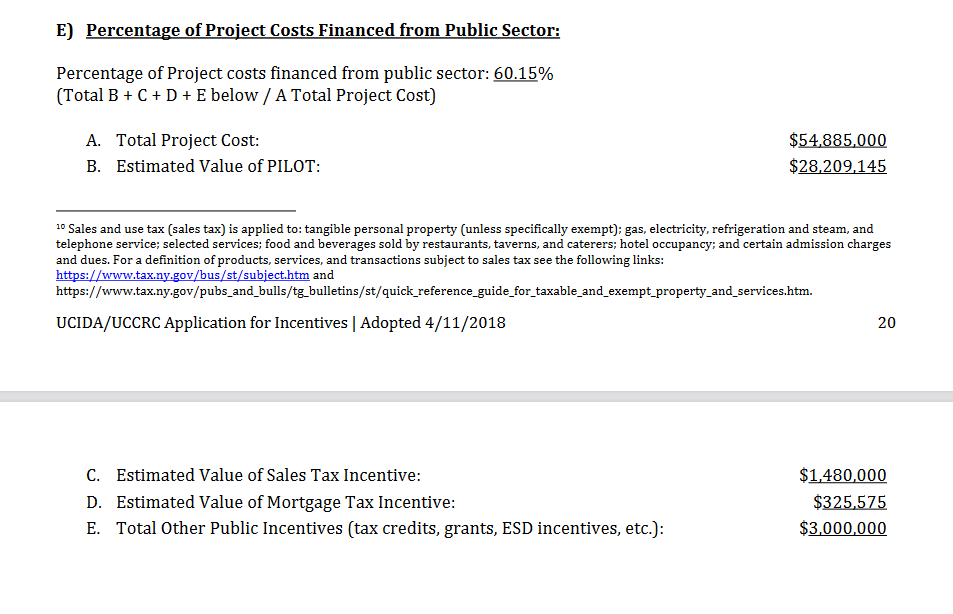

On pp. 20-21 of the application, pictured below, the developers acknowledge the Kingstonian is to be built on the backs of New York State taxpayers and schoolchildren to the tune of 60.15%, or $33 million, broken down into about $5 million in NYS grants and mortgage recording and sales tax exemptions plus a property tax break that will deprive Kingston, Ulster County, and the Kingston School District of $28 million.

Subsidies in the application

| PILOT | $ 28,209,145 |

| Mortgage Tax Incentive | $ 325,575 |

| Sales Tax Incentive | $ 1,480,000 |

| Grants | $ 3,000,000 |

| Total | $ 33,014,720 |

The project’s total cost is estimated at $54,885,000.

Sure enough, 33,014,720 divided by 54,885,000 = .6015, or 60.15%

Missing DRI grant

Note that the subsidies listed in the application omit $3.8 million in a Downtown Revitalization Initiative (DRI) grant.

If that incentive was included, the numbers would look like this:

36,814,720 divided by 54,885,000 = 67%

No mention of the most gargantuan subsidy: Opportunism Zones

The developers and city officials appear to have taken a vow of silence about this gigantic federal tax break that could eventually equal and possibly exceed the other subsidies. Tucked into the 2017 tax cut bill was the Opportunity Zone law, which exempts investors from paying capital gains tax on the sale of projects in an Opportunity Zone. Brad Jordan’s mall and much of Uptown have been named an Opportunity Zone, including the portion where the Kingstonian would be built.

Under the following conditions, the project would be subsidized 82-100% on the public dime

With multifamilies doubling in price each decade, according to the St. Louis Federal Reserve, by the early 2030s the developers could sell the project for $110 million, double the construction cost of $55 million. After paying off the mortgage, this would leave investors with a profit of roughly $80 million. Normally, this would be subject to a long-term capital gains tax of 15%, or $12 million. Because the project lies within an Opportunity Zone, the developers will be exempted from having to pay that $12 million tax. (Of course, this is simplified. Long term capital gains tax can range from 0% to 20%, and developers enjoy a plethora of deductions and depreciation benefits that come into play.)

To the $33 million in subsidies the developers list in their application, add the OZ subsidy of $12 million, and now total subsidies rise to $45 million.

45,014,720 divided by 54,885,000 = .82, or 82%. Say they sell at a higher price a few years later, for a profit of $100 million. That would give them an 87.5% subsidy. If they hold for another decade and sell for more than $220 million, the project would be entirely subsidized by the public. The steadfast refusal on the part of developers and local government to discuss the Opportunity Zone subsidy could be due to rumors that an alderman is one of the investors, or perhaps because it would spark awareness of the profit investors stand to make on the back of Kingston residents, or both.

Both a maze and an onion

Subsidies of this magnitude would put the private equity firm Blackstone to shame, because Blackstone purchased houses at roughly 30 cents on the dollar during the housing crisis, although with leverage the cost to the firm’s partners could have been much less. Unlike the relatively simple(r) process of vulture capitalists swooping in to scoop up thousands of houses in the blink of an eye, new developments take years to secure approvals from local commissions and boards. Most onlookers get worn out trying to navigate the maze of regulations, and they give up. Meanwhile, the developers have an army of lawyers and public relations lackeys who are paid to stay the course and stymie opposition.

Peeling the onion is a different yet equally daunting task. In Kingston, many council, board, commission and party machinery etc. members are either employees of the mayor and serve at his pleasure and therefore dare not cross him; are real estate agents and therefore cheerleaders; or own construction or insurance businesses that do business with the city and each other and also stand to profit from this development. The Ulster County IDA consists of businesspeople including those in real estate and construction trades and even a tenant of one of the developers, so conflict of interest raises its ugly head here too.

Socialism for the rich, rugged individualism for the poor

The Kingstonian is robbing the public and will perpetuate the housing crisis and inequality in general. It will open the door to other luxury housing developers demanding equally outsized handouts, and those developers will have case law on their side, because there is a lot of precedent on that.

But what about the economic benefits?

The inaccuracy of economic impact studies provided by firms that exist as a support mechanism to boost economic development is simply breathtaking. (See Bruce McLean’s excellent analysis.) These companies dutifully produce wildly optimistic job creation and tax revenue projections that reflect the desires of whoever signs the check. The so-called benefits to the public are a lie, and even the “economists” who predict these pie-in-the-sky benefits note in the small print of their very slick but vague bar chart-heavy reports that their conclusions are “for discussion purposes only” or cannot be guaranteed because they do not check the input numbers that the developers provide. Despite rosy projections hyped at Chamber of Commerce and other dog-and-pony shows, at the Sept. 9 presentation to the IDA the developers promised to create only 14 permanent jobs, of which 13 would pay $15 an hour. The application “estimates” 40 jobs will be created (see p.13 of application, of which 80% will be low wage.)

But aren’t there affordable units?

After much public pressure, the developers agreed to add 14 affordable units – but they are intended for people earning between 60-110% AMI, and with AMI rising because of the influx of New York City professionals, that could soon mean families with incomes of $100,000.

But what about the garage?

See here.

But the developers said it would be green.

See here.

But don’t we need housing at all price points? A “healthy mix”?

No. This favorite developer talking point is easily debunked by a look at local as well as global conditions.

Locally, developers and their allies in government bemoan a vacancy rate of about 2%. But when a study was conducted to determine whether Kingston fell under the 5% threshhold to qualify for rent control, the results rolled in at 6.7%. Curiously, this came about at a time when a local investment group was in talks to purchase five apartment complexes in and near Kingston from a slumlord who failed to maintain the properties, leading to unsafe and horrific conditions, while simultaneously raising rents and evicting tenants. The new investors themselves promised to re-sell the complexes within five years with “meat on the bone,” meaning even more rent increases down the pike. One interpretation: Local government failed to enact and enforce housing standards, preferring to game the rent control study in order to favor the new buyers. Recently, I visited one of those properties, and someone who claimed to work there told me at least 30 apartments were vacant. I walked into one of them, and it was in the process of being rehabbed. I asked a tenant whether the new owners were providing better service. “Good luck with that,” she said. “It would be rare to find someone if you needed help.”

Expert Aaron Glantz, author of Homewreckers, an account of the housing bust, notes that when vulture capitalists were looking to buy houses on the cheap, “everyone said we had too much housing. Too many suburbs, too much housing, when houses were foreclosed, nobody would buy them because we were told that we had too much housing. And now we’re being told we don’t have enough housing. And, and so instead of looking at that question, let’s, you know, take a really hard look at our system of finance, you know, who is financing people to buy housing? And or if not people, corporations to buy housing? And then what are they doing with it after they acquire it?” [Ed. Note: That quote took place during a conversation between Glantz and Leilani Farha, former special rapporteur to the United Nations on housing insecurity.]

Kingston lawmakers may be uninformed about these causes and ramifications, but one mayor in Ulster County gets it. Please read this post by New Paltz Mayor Tim Rogers.

The high end housing market is perfectly capable of funding itself. Robbing everyone else is economic feudalism.

Local legislators fall over themselves in rush to feed pigs at the public trough

The Kingstonian’s approval process has been tainted with corruption, with City Hall firing the non-complaisant and shutting down opposing views in violation of the law. With the process into its third year, City Hall continues to pack the necessary boards with yes-men. The silence of several unelected leading advocates has been purchased with small grants and promises that may never come to pass.

Pro-development local officials and the developers themselves have told verifiable whoppers, although Donald Trump’s lawyers have shown that elected and appointed officials, and their lawyers and public relations firms, can lie all they want, so long as it’s not in court.

One partner in the Kingstonian – Joseph Bonura — is no novice when it comes to drinking from the public punch bowl. In the nearby city of Poughkeepsie he has a tax break worth $1 billion — that’s right, billion with a B — and is currently embroiled in litigation with Poughkeepsie city government. The other developer, Brad Jordan, owns much of the land that would be developed and also owns a fairly large building supply company. He himself has a history of trying to sell unsuitable land to the Kingston School District. The other owner of land on which the development would rise is the City of Kingston, and the mayor is trying to transfer a street and a piece of property to the new owners via methods of questionable legality that bypass statutory requirements for Common Council votes.

Want to know more about tax breaks for luxury housing?

The tax swindle’s centerpiece is one special flavor of tax break called payment-in-lieu-of-taxes, or PILOT. This kind of tax break is growing in popularity in New York State and in Kingston has more than quadrupled in the last few years. PILOTs are property tax breaks, which means the biggest losers are school districts, with municipalities and counties also losing revenue, albeit to a smaller extent. In the Kingston school district, for example, about $4 million is lost every year to PILOTs.

State grants round out the trifecta, including Governor Andrew Cuomo’s pet Downtown Revitalization Initiatives (DRI) award – the $3.8 million grant the developers omit from their latest application — and $3 million in other economic development grants. Similar projects layering the three kinds of giveaways are on the drawing board in Plattsburgh, Albany and probably many more cities throughout New York State.

A local boondoggle, but also part of the national and global pandemic of homelessness

Kingston was recently reported to boast the fastest appreciating real estate prices in the nation, and the story must be seen within the framework of low interest rates and monetary policy that sends money flows to banks, which like to lend to real estate because there is always an asset to seize in the event of a crisis.

Like the rest of the nation, Kingston has an unacceptable homelessness problem that will only worsen once the wave of post-Covid evictions and foreclosures comes crashing down. About 15 years ago, a Woodstock real estate agent born during the baby boom years told me that since his cohort had stopped doing drugs, real estate “was the only game in town.” Sadly, this mirrors the financialization of our economy and the lack of opportunities in productive areas. Little things, like fixing infrastructure so roads don’t crumble, so the power doesn’t go out, so offshore hackers don’t break into the DoD, so our planet doesn’t go up in flames.

The Kingstonian would seem to be a small swindle, but given the global problem of excess luxury housing construction while millions are homeless, and given the long-term negative consequences for Kingston, this classic example of privatization of profit and socialization of loss should be stopped cold. Fueled by endless false narratives and pushed through the approval process by integrity-challenged local officials, the Kingstonian giveaway is one more reason for Americans to lose faith in their institutions.

Some communities are waking up. On Monday, New York State legislators introduced a proposal to stop Opportunity Zone boondoggles, following the lead of North Carolina, California, Massachusetts and Mississippi. And in Washington, several bills have been introduced in Congress to close loopholes or eradicate the program entirely.

-0-