FUN WITH NUMBERS

Fun for investors, not so much for everyone else

July 24, 2020

Ed. Note: This story was updated March 2022 to reflect better estimates.

Kingston, NY – With potential profits and investor identity still under wraps, the “trade secret” canard has enabled developers Brad Jordan and Joseph Bonura to focus their presentations on how much the Kingstonian and its air-conditioned garage will benefit the community.

But with real estate finance fairly standard and good tutorials available online, free and low-cost templates enabled this piece to focus on how much the Kingstonian will benefit Jordan, Bonura and the remaining investors.

An estimate of just how much investors stand to take home requires a look at two sources of profit: 1. Income during the ten-year required holding period for an Opportunity Zone fund and 2. Profit from the sale, which can take place any time after the ten-year holding period.

Income During the Ten-Year Minimum Holding Period

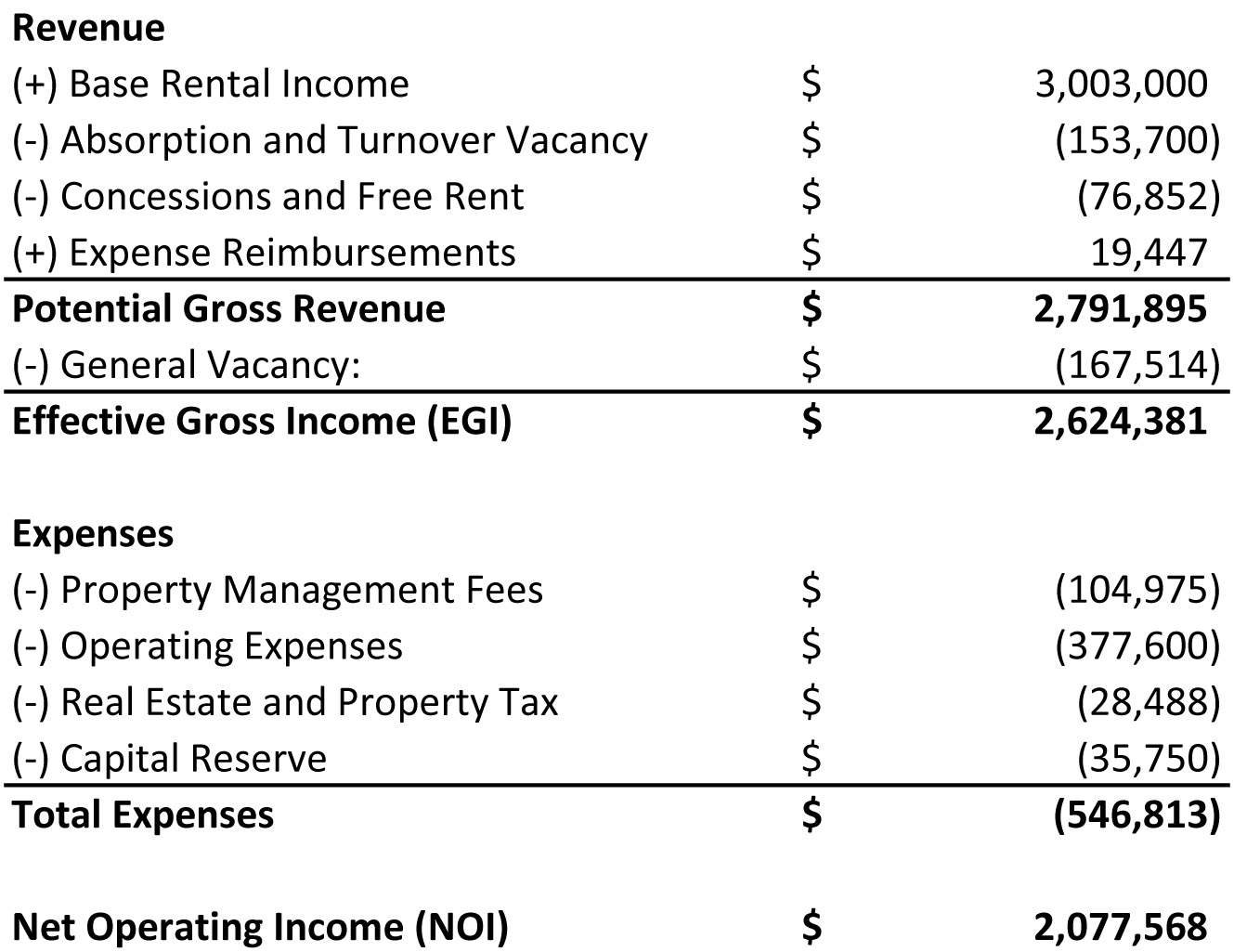

Several methods exist to project Net Operating Income, including the pro forma statement, estimated Net Operating Income by rule of thumb, and cap rate.

First, here is a simplified pro forma statement computed for the 143 apartments in the Kingstonian, assuming an average rent of $1,750.

A second way to estimate Net Operating Income is the rule of thumb that NOI is 60% of gross revenue. Here, 60% of $2,791,895 gives a NOI of $1,675,137.

The discrepancy between the two possible NOI results is that the 60% rule of thumb applies when owners are paying their fair share of property tax, which is not the case with the Kingstonian. An approximate midway point between these two results is $1,875,000.

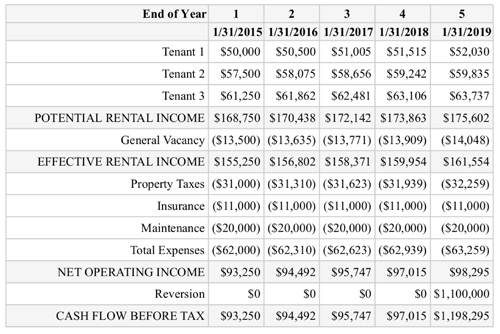

Here are sample pro forma statements for hotels and storefronts, which could be adapted for the Kingstonian.

This is a pro forma for a Cobblestone hotel with 44 rooms that charges only $103 a night. Probably rates in Kingston would be closer to $200, and occupancy would be higher than the 58% occupancy expected for 2020. NOI would probably be similar to the estimated $480,000.

Here is a pro forma of three storefronts only, compared with the 9,000 sq. ft. the developers plan to offer, indicating that NOI of around $300,000 is within the realm of possibility.

Let’s round up the hotel and storefront NOI to a combined $800,000 .

A third way to estimate NOI is the so-called cap rate, a formula that can be calculated on the back of an envelope and which is equal to Net Operating Income divided by the property’s value and then rendered as a percentage. This allows one to work backwards to take a good guess at NOI.

NOI / Price = Cap rate. Or, NOI = Cap Rate x Price

Cap rates vary, from a low of around 4% on newly-constructed high end property to a high of 9%, with boutique hotel cap rates edging toward 10%.

If the Kingstonian’s cap rate averages 7% between retail, hotel and apartments, NOI could shape up this way.

Let’s say that using the so-called cost valuation method, the apartments, storefronts and hotel are worth around $40,000,000. (Total value of $57.8MM, from the developer’s IDA application, minus $17.8MM for the garage.)

Then, NOI would be $40,000,000 x .07 = $2,800,000

This NOI is quite within the realm of possibility, with the apartments bringing in $1,875,000 NOI, and the hotel and retail making up the difference of about $1 million, calculations that comport more or less with those posted above.

What about debt and property tax?

Remember, there will be no property tax other than the small PILOT, and deductions should bring income tax down to zero, but there will be debt service.

Annual payment on $43 million dollar 30-year mortgage at 3.5%: $2,300,000

Take away the annual mortgage payment from a guesstimate NOI of $2,800,000, and this leaves a ballpark take-home profit of $500,000 every year.

The Real Payday Comes when the Developers Sell

Opportunity Zones require the investor to hold the property for ten years in order to legally avoid paying capital gains tax, and they must sell by Dec. 31, 2047.

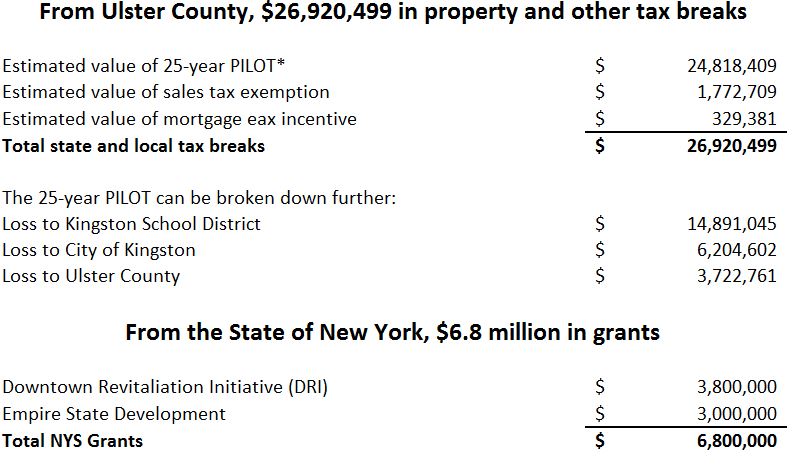

Why is the Kingstonian project a taxpayer issue?

Because the developer is seeking large, multiple subsidies from the city, the school district, the state, and the federal governments. Specifically:

*PILOT stands for Payment in Lieu of Taxes. It means the developers would receive a property tax abatement and instead pay a small fee equal to a small share of what they would have normally owed.

Opportunity Zones (OZs) reduce capital gains taxes for wealthy investors — three ways. First, when an investor put capital gains into an OZ project, s/he can delay paying the tax. Second, if s/he leaves the original investment in the OZ for a certain period, the capital gains tax rate on those investment dollars goes down. Third, when the investor exits the project, again after at least a certain time period, all of the appreciation (i.e., capital gains) is tax-free.

The Opportunity Zone tax exemption is lucrative: high-income people would normally owe a 20% federal income tax on capital gains. So, assuming the property appreciates over time, the OZ designation would make the Kingstonian potentially much more profitable.

Consider this back-of-the-envelope scenario: according to the St. Louis Federal Reserve, multifamily properties approximately double in price every decade. If the Kingstonian costs $60 million to build, that means that in a decade it will be worth $120 million, for $60 million in capital gains. Because it is in an Opportunity Zone, the sellers would not owe the 20% capital gains tax, for a savings, or extra profit, of $12 million. The investors would also get reductions in capital gains taxes owed on their original investment.

Now, consider this scenario: if the trend in multifamily appreciation holds, in 20 years the Kingstonian will be worth $240 million, for a $180 million capital gain. Because it is in an Opportunity Zone, the sellers would not owe the 20% capital gains tax, which translates into a higher profit of $36 million. The investors would also get reductions in capital gains taxes owed on their original investment.

Inquiring Minds Want to Know

Q: What about income tax?

A: With depreciation, expenses, and paper losses, it is unlikely that the developers will pay much if anything in income tax, and they may even be gunning for a refund. Here’s how it’s done. Click on the link for a look at how small fry do it.

Q: According to this article in Bloomberg, Opportunity Zone investors like to see a 12-16% return on their money. Does this dovetail with available information?

A: We don’t know, because we don’t know how much cash the investors have leveraged. The smaller their cash investment, the greater their relative profit. Remember, it’s one thing to invest $100 at a few percentage points and take home $125 in a decade. It’s another thing to invest $10, borrow $90 and then take home $30 in a decade. You pay back the $90, plus interest, and ahhh, the magic of leverage. The lender has gotten 3.5%, but you’ve tripled your money.

If we assume that investors have plowed in $6 million, and at the end of ten years you take home $90 million, no fancy math is required to figure out you’ve way more more than tripled your money.

These numbers may not approximate the developers’ projections, and in fact they may underestimate profit, but they are well within the realm of possibility and have been vetted by a seasoned developer who has done hundreds of millions of dollars in deals and who heads a well-respected MBA real estate program.

Please remember that on this Friday, July 24, 2020, Republicans in the U.S. Senate would like to cut the excess unemployment payment to $100 – even in states like Mississippi, where the average weekly unemployment payout is $206, while here, in New York State, it is an entrenched small city Democratic establishment that is spearheading the push to give $30 million in tax breaks to millionaires who will net untold millions building on unsuitable soil a climate-controlled luxury garage for luxury cars in a luxury complex that will serve a shrinking class of luxury tenants who will one day disappear if everyone else can’t afford a roof over their head, much less the car that won’t need a garage because it will have long since been repossessed.

-0-