A Peek at the Perks for Kingstonian Investors

Ed. Note: Updated Feb. 25, 2022 to reflect possible new tax break schedule.

Jan. 25, 2022

Kingston, NY – The LA Times columnist’s quote above refers to the privatization of libraries, but it could just as well refer to the privatization of city property, a city street, city parking, and tens of millions of the public’s dollars. The Kingstonian’s developers have long trumpeted the supposed benefits of the multi-use project they want to build in this now-trendy city on the Hudson River, but they are silent on the profit they will pocket and the costs to the people of Kingston and Ulster County.

Background: The Kingstonian is proposed $55-60 million high-end housing development consisting of 143 apartments, boutique hotel, garage and retail space to be built almost if not entirely at taxpayer expense. To be developed by property owner Brad Jordan and his unidentified investors, who are rumored to include elected officials, the project is funded on the public dime to the tune of 60.15% through New York State grants and a property tax break that will deprive Kingston, Ulster County, and the Kingston School District of $28 million. Another subsidy, the Opportunity Zone tax break from the Trump tax-cut bill, is poorly disclosed yet over time could also become worth millions. Upon sale, the investors will likely pocket around $100 million if they hold for ten years — not bad, considering their cash investment is $6 million.

More privatization: the Kingstonian would result in the demolition of an affordable City-owned parking lot with 138 spaces and the parklet on N. Front Street, which have been transferred free of charge to the developers. Parking now costs Kingston residents only $100 a year and would rise to a minimum of $720. It would also result in the loss of Fair Street Extension, which is being “repurposed” as a public space and garage access.

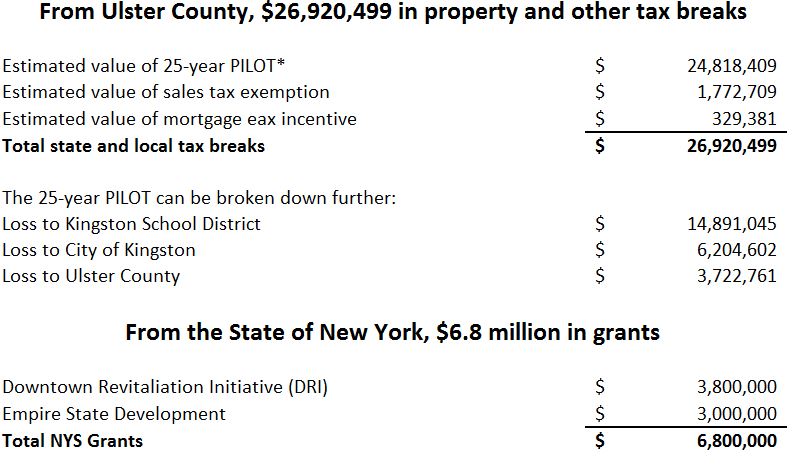

The public subsidies include $33.7 million from New York State and three local governments. The Kingston School District alone would lose almost $15 million.

After the construction phase, the Kingstonian would create 40 permanent jobs. However, retail and parking-lot jobs are typically low-paid with minimal benefits.

Why is the Kingstonian project a taxpayer issue?

Because the developer is seeking large, multiple subsidies from the city, the school district, the state, and the federal governments. Specifically:

*PILOT stands for Payment in Lieu of Taxes. It means the developers would receive a property tax abatement and instead pay a small fee equal to a small share of what they would have normally owed.

Opportunity Zones (OZs) reduce capital gains taxes for wealthy investors — three ways. First, when an investor put capital gains into an OZ project, s/he can delay paying the tax. Second, if s/he leaves the original investment in the OZ for a certain period, the capital gains tax rate on those investment dollars goes down. Third, when the investor exits the project, again after at least a certain time period, all of the appreciation (i.e., capital gains) is tax-free.

The Opportunity Zone tax exemption is lucrative: high-income people would normally owe a 20% federal income tax on capital gains. So, assuming the property appreciates over time, the OZ designation would make the Kingstonian potentially much more profitable.

Consider this back-of-the-envelope scenario: according to the St. Louis Federal Reserve, multifamily properties approximately double in price every decade. If the Kingstonian costs $60 million to build, that means that in a decade it will be worth $120 million, for $60 million in capital gains. Because it is in an Opportunity Zone, the sellers would not owe the 20% capital gains tax, for a savings, or extra profit, of $12 million. The investors would also get reductions in capital gains taxes owed on their original investment.

Now, consider this scenario: if the trend in multifamily appreciation holds, in 20 years the Kingstonian will be worth $240 million, for a $180 million capital gain. Because it is in an Opportunity Zone, the sellers would not owe the 20% capital gains tax, which translates into a higher profit of $36 million. The investors would also get reductions in capital gains taxes owed on their original investment.

For a look at at the Kingstonian’s “sizzle, fizzle, and sleight of hand,” please see Fake Data, Fake Benefits and Tax Break for Valet Parking. As for Opportunity Zones, investors — particularly very wealthy investors — love them. Many “are poised to reap billions in untaxed profits on high-end apartment buildings and hotels in trendy neighborhoods,” reports David Yaffe-Bellany of the New York Times. Sadly, our electeds in Kingston and Ulster County never saw through the sleight of hand or, worse, are caught up in the boondoggle themselves.

-0-