Friends With Benefits

Consultant With Ties to Developers Concludes Kingston Will “Benefit” from Project

New tax giveaways hammered out; Ulster County officials act as go-between to secure arrangement agreeable to developers

Nov. 2, 2020

Background

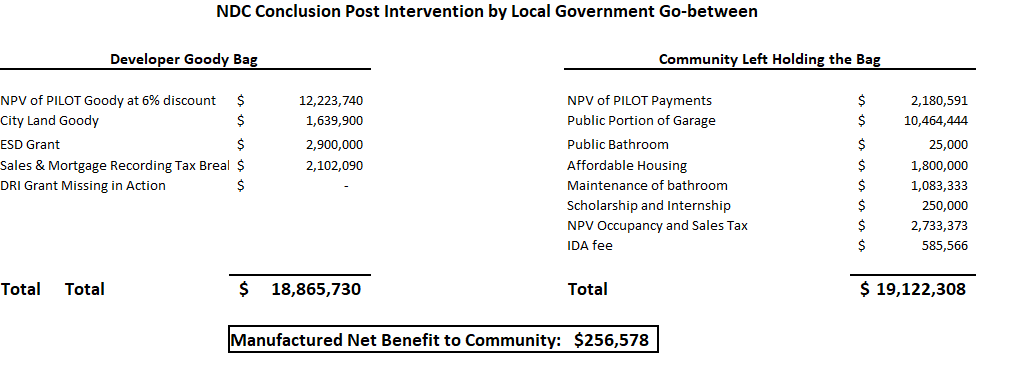

The Kingstonian is a proposed $60 million development consisting of 143 apartments, boutique hotel, garage and retail space. In hopes of securing a $30 million tax break, the developers produced an assortment of job creation and economic activity projections. In response to public outcry about the wildly optimistic numbers, Ulster County commissioned a review by the National Development Council, or NDC, a company whose CEO has decades of personal affiliation with one of the developers and various Ulster County businesses and governmental commissions. Despite the long-standing relationship, the NDC produced a report that wasn’t sufficiently agreeable to the developers. After intervention by persons unknown, a report was released Friday, Oct. 24 that reduced the tax giveaway to $27 million and raises total PILOT payments to about $5 million.

Experts dispute validity of studies

This article accompanies a podcast with economist Jon Sanders of the John Locke Foundation. In the podcast, Sanders, a free-market economist who specializes in regulatory issues, says economic impact studies are more akin to alchemy than to economics. He discusses in broad strokes the shortcomings of economic impact reports such as ignoring opportunity costs and the law of diminishing returns, and allowing the manipulation of numbers inputted into the programs. This article zooms in on the last category and looks at a sampling of tricks used in the NDC report to repackage the $28 million giveaway as a “benefit” to the community. Links to documentation are found here as well as in the transcript of the podcast. Other economists and activists interviewed in podcasts shown on this website have come to the same conclusion as Sanders, and a growing body of scholarly work indicates they are correct.

As Sanders would say, the NDC impact report is full of, well, alchemy, and here are five of the many alchemy tricks employed to fool the the community and local lawmakers into believing they’re being sold gold instead of dross. But first, here is the “benefit” to the community, as divined by NDC.

ALCHEMY MATH TRICK #1: Lies, Damn Lies, and NPV Discount Rates

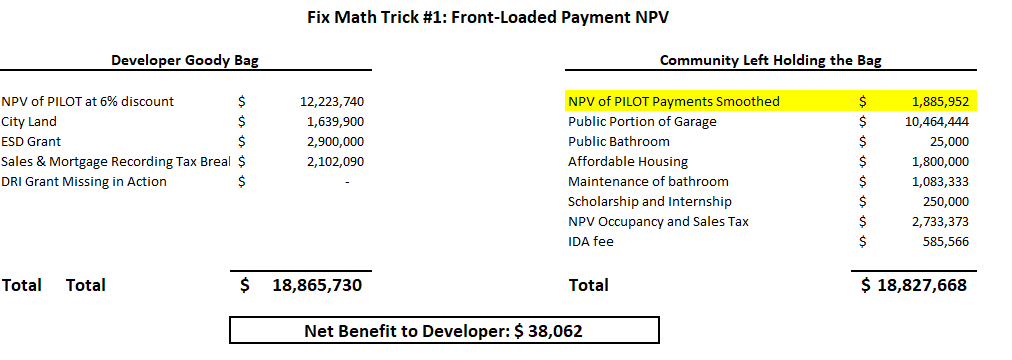

Net Present Value (NPV) is a metric employed in finance. Here, it’s used to gin the numbers up to make the $27 million gift to the developers look like a steal compared with the previous $30 million tax break. What a bargain! The NDC juiced the “benefit” to the community by bumping up the PILOT payment in Year 4. Here’s a fun math trick: Consider the schedule NDC provided, where PILOT payments total $5,056,572. The payment starts out at $40,000 a year and is bumped up to $140,000 in Year 4. Run the NPV using NDC’s chosen discount rate of 6%, and what is NPV? $2,180,951, just as their “benefit” chart predicts. Now, take the total PILOT payment of $5,056,572 but instead of increasing the payment in Year 4, average it out for a smooth increase each year and then run the NPV using their chosen discount rate of 6%. As if by alchemy, NPV is now only $1,885,952. This is $294,640 LESS. Subtract that from the community “benefit” side, and you’re in negative numbers territory. Thank you, NDC, for this extra trick to make it look like developer “benefits” to the community exceeds the benefits to the developers themselves. You may notice no such smoothing was applied to the developers’ side of the equation. That would have made the developers’ benefit even larger.

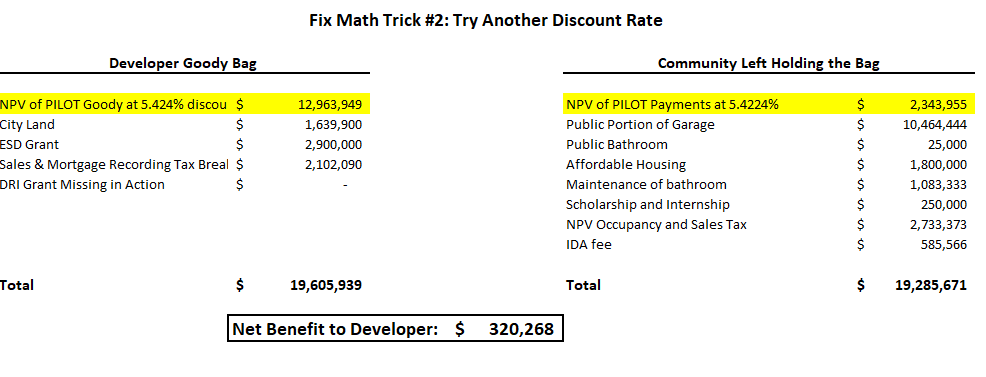

ALCHEMY MATH TRICK #2: Speaking of 6% discount rates to find NPV, what makes this the correct number to begin with? Well, maybe it’s not. Check out the chart on P.9 in this paper from Property Metrics, which suggests that the proper discount rate is the risk free rate of the 10Y T-note plus a commercial real estate risk premium of 4.55%. With the 10Y Treasury yielding .874% on the last trading day of October, that would give 5.424% as the correct discount rate, and an NPV of $12,963,949 for the community’s PILOT gift to the developers vs. the community’s PILOT “benefit” $2,343,955 from the developers. Compared with the NPV numbers at a 6% discount rate, this is wider gap of $576,846 which once again wipes out the supposed net benefit of $256,578.

Or, you could look at cap rates in Q3 to try to find blended cap rate. While there’s nothing specific for Ulster County, properties here have been appreciating at the fastest rate in the nation, and with cap rates inversely proportional to value, the Kingstonian’s presumed blended cap rate is plummeting. Why is this relevant? Turns out that another method of picking the correct discount rate is to take the cap rate and knock off a percentage point or so and add in growth. Again, this will kick the net “benefit” to the community into negative territory and will confirm what anyone knows intuitively, that the only benefit here is to the developer.

Or, you could use the 10-Year rate by itself, which shows that the real benefit to the developers is almost the full value of the tax break and the “benefit” to the community is bupkis. But we knew that anyway.

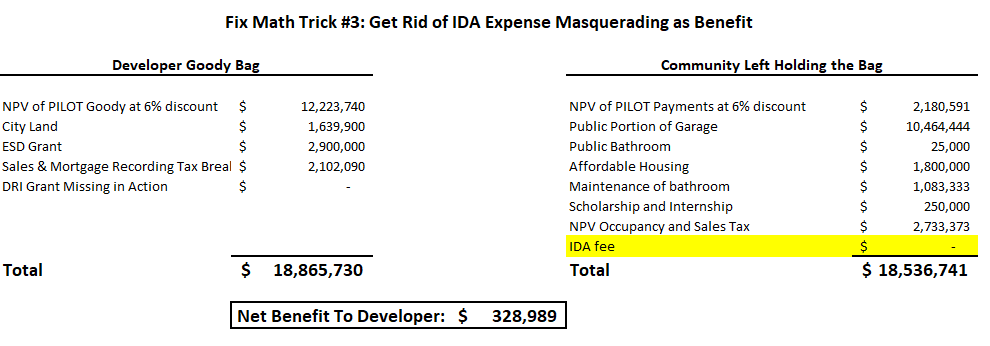

ALCHEMY MATH TRICK #3: As if by magic, developer expenses morph into “benefits” to the community.

Behold the IDA fee of $585,566, listed as a benefit to the community. Really??? Let’s see, an old boys’ network that give tens of millions in tax breaks to connected insiders, depriving schools and towns of revenue that would otherwise fund laptops to students and keep the streets clean, not to mention help prevent Kingston’s budget from dipping into reserve funds. For the most egregious example, consider the property tax break for the Holiday Inn in Lake Katrine, which is owned by Intercontinental, a UK-based publicly traded company whose largest shareholder is JPMorgan Chase. The schoolchildren of Kingston must be proud to know they’re subsidizing Jamie Dimon and his fellow paupers. What a benefit!

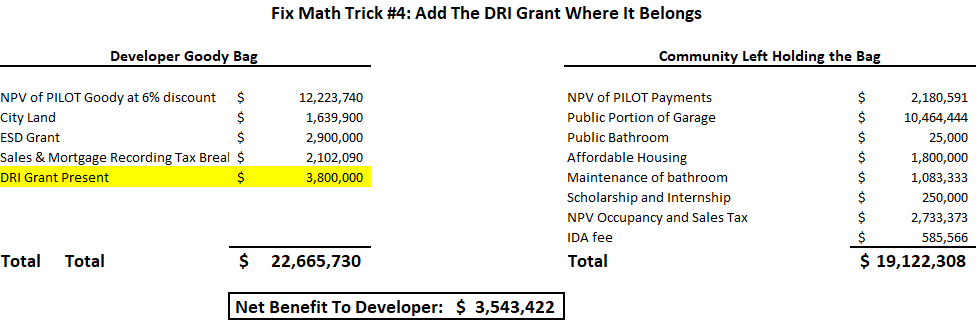

ALCHEMY MATH TRICK #4: Notice anything missing from the “Project Benefit” portion, i.e. the welfare-for-millionaires side of the equation? Like, maybe the $3.8 million DRI grant? According to the review, “An additional $3.8 million will come from the Downtown Revitalization Initiative (DRI) grant, a competitive source from the State of New York and received directly by the City of Kingston. The DRI will fund a variety of site work and infrastructure costs, including demolition and utility relocation. This is separate and distinct from the developer’s $58.6 million budget.” Why is it separate and distinct? That site work wouldn’t be necessary if they weren’t building the Kingstonian. The DRI grant belongs in the developers’ goody bag and should thus be accounted for.

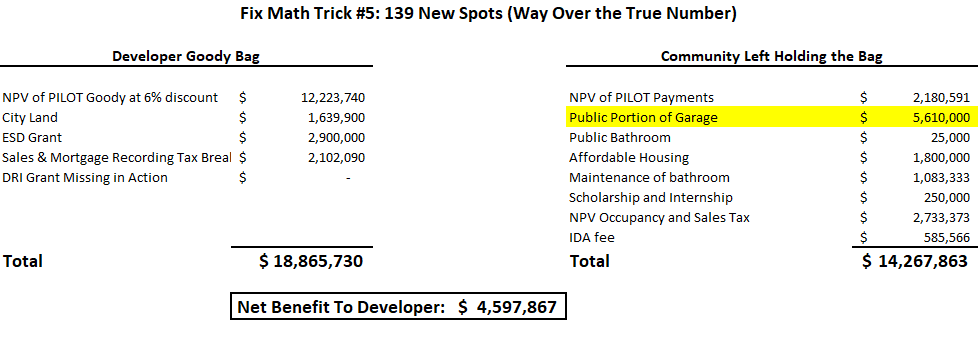

ALCHEMY MATH TRICK #5: False parking assumptions. The NDC accepted the developers’ contention that 277 parking spots would be available to the public. Even if you’re naïve enough to believe 277 spots lie waiting to be claimed by the random public’s car, there ALREADY exist 138 spots in the lot, so that means only 139 are newly created for the public, i.e. 33% of the spots and 33% of the cost, which means the so-called “benefit” should be priced at $5,610,000, once again proving that benefits to the developers tower over benefits to the community.

In reality, somewhere between -8 and +30 new spots will be available to the public. Does anyone really need the math on that?

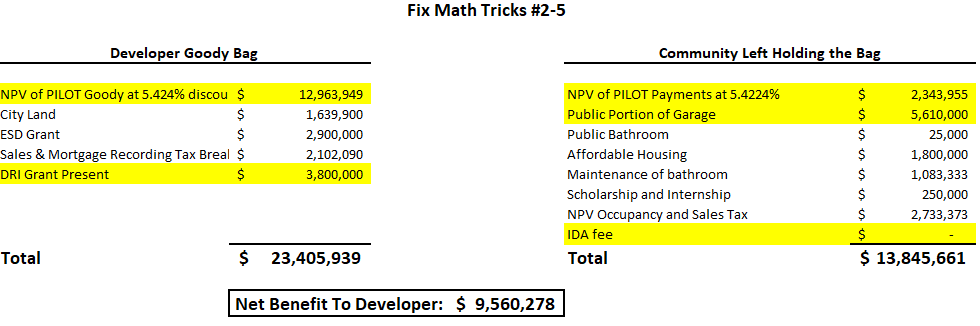

ALCHEMY MATH TRICKS #2-5: Remember, this is only an understated sampling of the overstated “benefits” to the community.