Opportunism Zones: Developers Shoot the Moon

Take-home Could Top $200 Million Yet They Ask For $27 million Tax Giveaway

Nov. 11, 2020

If Trends Hold, Developers Eye Enormous Payday after 10-year lockup.

If present trends in multifamily prices continue, investors in the Kingstonian luxury development could pocket anywhere between $90 million and the moon once the ten-year Opportunity Zone required holding period expires. The complex could be worth $120 million after its first decade and $240 million by the end of 20 years. If the investors sell as soon as the lockup ends, about $90 million will be left over after the mortgage is paid off. That’s $90 million in profit, tax free. If they wait another decade, they could take home more than $200 million.

Background

The Kingstonian is a proposed $60 million development consisting of 143 apartments, boutique hotel, garage and retail space. In hopes of securing a $30 million tax break, the developers produced an assortment of job creation and economic activity projections. In response to public outcry, Ulster County officials brokered a new agreement released Oct. 24 that reduced the tax giveaway to $27 million and raises total payments-in-lieu-of-taxes (PILOT) to about $5 million.

Look Here, Not There

To support their claim that they cannot build the Kingstonian “but for” the PILOT, the developers have steered the discussion to vaguely defined operating revenue projections for the next 25 years. However, they are silent about their gargantuan payday when they sell the property.

In order for investors to avail themselves of the Opportunity Zone exemption from state and federal capital gains tax, they must remain invested for a minimum of ten years, and they must dispose of their holdings by Dec. 31, 2047.

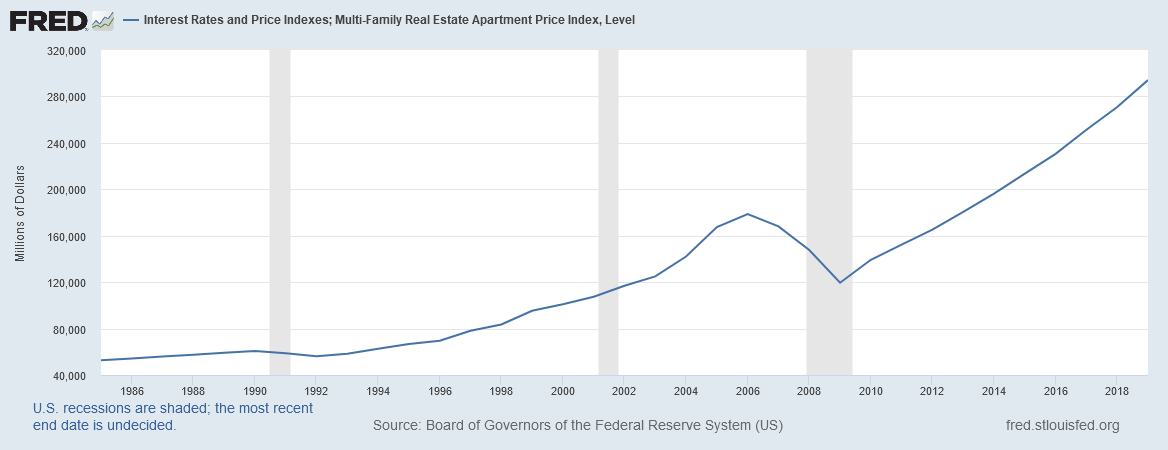

Below is a chart from the St. Louis Fed showing price appreciation of multifamily complexes since the mid-1980s. Apart from a few decades, notably the housing debacle of 2007-2009, prices have at least doubled in most ten-year periods. In fact, from 2010-2019, prices rose by an astounding 160%.

If the doubling each decade continues and the $60 million construction cost of the Kingstonian is used as a starting point, this means that in ten years, the project will be worth $120 million, which means that tax free profit would be $60 million. If the developers keep it for another decade, the complex would be worth $240 million – for a profit of $180 million.

Giveaway dressed up as public-private partnership

Despite these eye-popping numbers, the developers say they can only afford to pay $5 million in property tax over the next 25 years.

Emails were sent to experts asking whether the construction cost was the correct base number, or whether comparables were a better valuation, and whether interest rates and demand for rental apartments were expected to continue unchanged over the next few decades.

A spokesperson at the St. Louis Fed sent an email to the effect that no one there would be able to comment on real estate trends in the Hudson Valley.

This recent sale indicates that the Kingstonian’s construction cost of $60 million is in line with comparables and should be used as a valuation.

Like stealing candy from a baby

Supporters of the PILOT have fallen for the developers’ argument that any increase in tax dollars is better than none; 277 new parking spots will be available for the public; sales tax dollars will flow, and job creation will flourish because of the Kingstonian. But economists cite the law of so-called lost opportunity costs to prove that other uses will be found for the property that in this case also would generate as much or more tax. In fact, the developers have said they originally were kicking around ideas only for Brad Jordan’s two parcels, and the City-owned land was added later.

PILOT still needs approval

The Ulster County Legislature, the Kingston School Board, and the Common Council are required to vote on the Oct. 24 proposal. Asked how he would advise government to proceed vis-à-vis the PILOT, Albany Law School professor Edward De Barbieri called on elected and appointed officials to “engage in a true process, not just the appearance of process.” De Barbieri recently published this article on Opportunity Zones in the Yale Law & Policy Review, and a podcast with him on incentives, including OZs and the Kingstonian, can be heard here.

Opinions differ on whether any property tax break is allowable

Some observers maintain that a PILOT is out of the question in this case because only retirement housing is permitted under Industrial Development Agency (IDA) law. But the Kingstonian team is counting on a lower court ruling, Ryan v. Hempstead IDA, which allows for residential development if the project satisfies the IDA law’s goal of “preventing unemployment and economic deterioration.” This explains why the Kingstonian’s IDA application is littered with buzzwords from that decision as well as from the IDA law. It was unclear whether the project would satisfy Ryan v Hempstead’s unemployment mandate, given the developers’ acknowledgment in a Sept. 9 presentation to the IDA that they could guarantee only 14 permanent jobs, of which 13 would pay $15 an hour. The math: that’s like paying the developers almost $2 million to create each job. Then, it would take each worker almost 46 years to earn back that $2 million. Meanwhile, Kingston’s schools would be deprived of $15 million that could provide children with skills to compete in today’s tech savvy arena.

It was also unclear whether Kingston needs help in preventing economic deterioration, given that it recently notched the nation’s fastest increase in housing prices. In Ryan v Hempstead, the court justified its decision on grounds that the development there would retain workers in need of affordable housing. But apart from 14 workforce apartments destined for renters who earn between 60-110% AMI, the Kingstonian is offering high end market rate housing and is geared to empty nesters seeking to downsize as well as young people who can afford luxury rents. It also was not clear whether Ryan v Hempstead would survive a challenge on appeal.

Others oppose the giveaway’s enormity and developer team dissembling

Another camp doesn’t mind the project but objects to the PILOT’s enormity and history of questionable behavior on the part of the developers and their political allies.

James Michael, a school board member, has said the project could be the “Taj Mahal” of Kingston but that he was unwilling to forego millions of dollars in lost revenue to the Kingston School District. Moreover, James said Kingston Mayor Steve Noble was caught lying to the school board when he said a large state grant would disappear if the PILOT was not approved. State officials have confirmed that any unused portion of the grant can be re-allocated.

This lie, which was also disseminated by the developers themselves, may have been intended to arm-twist the school board into approving the PILOT by instilling fear that the school board would lose its portion of the grant. The Downtown Revitalization Initiative $10 million grant had allocated $3.8 million for the Kingstonian and $2.5 million for Dietz Stadium, which is used by Kingston students. Watch Bonura claim the DRI money “goes away” at his presentation on July 8, in this recording of his presentation to the Ulster County Industrial Development Agency at 1:46:58 https://www.youtube.com/watch?v=n7ZpSh2s2bw&feature=emb_err_woyt

New Paltz mayor Tim Rogers has issued statements detailing how tax breaks such as PILOTs harm local governments as well as school districts. In Poughkeepsie, the Common Council has complained that developer Joe Bonura has failed to live up to his part in tax breaks worth more than $1 billion over 99 years.

Asked how he would advise Ulster County elected and appointed officials to proceed vis-à-vis the PILOT, Albany Law School professor Edward De Barbieri called on local officials to “engage in a true process, not just the appearance of process.”

Here are several reports from companies that serve the real estate market.

https://www.realtymogul.com/knowledge-center/article/2020-multifamily-housing-trends

https://www.cbre.com/research-and-reports/Global-Real-Estate-Market-Outlook-2020-Multifamily

https://www.parcelpending.com/blog/multifamily-market-trends-growth-in-2020-and-beyond/

https://www.smartcapgroup.com/blog/understanding-real-estate-investment-returns

Emails requesting comment were sent to Arbor Realty, the St. Louis Fed, and Freddie Mac.

A spokeswoman in public affairs department at the St. Louis Fed emailed, “St. Louis Fed economists most likely won’t be able to give you insight into what is happening now or prospects in the future for the Hudson Valley.”