Opinion

The Kingston School Board Should Vote NO, Because The Kingstonian Numbers Simply Don’t Add Up

By Bruce McLean

Nov. 27, 2020

To Members of the Kingston School Board:

As former City Republican Chairman and present Treasurer of The County Republican Committee, I am writing to request you vote NO on any PILOT request for the proposed Kingstonian development in Uptown Kingston.

This is not a political issue, but rather a financial issue that bridges political divides, age groups and income brackets. You might say it is a “melting pot” of concerned, fiscally responsible citizens.

(1) The Kingstonian’s $19 million assessed value is one-third of the full stated value of the project of $58.7 million. This means that out of the gate the developers are getting a 66% tax break below Full Market Value, or FMV – but still, they want more. If the property was assessed at FMV, city taxes would be $916,307, school taxes would be $1,825,570, and the county tax $253,000. This adds up to $2,994,877 – more than triple the $932,000 currently due on a $19 million assessment. So right from the get-go, each taxing district has left on the table two-thirds of tax revenue, and this benefit flows directly to the developers’ bottom line. And what have the developers offered to pay instead? $40,000.

| Property tax at FMV | $2,994,877 |

| Property tax at proposed assessment | $932,000 |

| PILOT sought by developers | $40,000 |

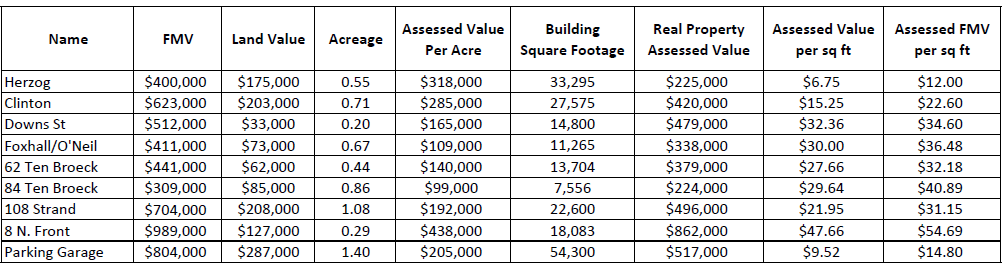

(2) The original proposed PILOT payment was $28,000, which is what the developer pays on the site now. But already he is favored with a lower assessment than eight similar properties in the city of Kingston. In fact, the property labeled Clinton, four blocks away and smaller in size, is assessed at 50% more per acre and square foot than the developer’s parcels. Other properties throughout the City, some in less desirable locations, demonstrate even wider disparities. So once again, developer and property owner Brad Jordan benefits from favorable assessments that are significantly lower than those on comparable properties. It should be noted that the developers have since offered to raise their PILOT payment to $40,000. See Exhibit A, below.

(3) Based on the city assessment rolls, the developer will be getting an $800,000 piece of property (the present parking garage) plus one block of a two-lane street in Uptown Kingston. For discussion’s sake I have put a value of $200,000, although it may be more. It is quite possible that $1,000,000 in property is being transferred to the developers at no cost. This is a potential loss to the City and calls into question the fiduciary and due diligence obligations of elected officials, and perhaps employees of other agencies as well.

(4) Pinpointing the true number of new parking spots is an elusive goal, with different figures put forth in the numerous developer presentations. This is what we know: the developer maintains there will be 420 spots in total upon completion, compared with 144 spots at present, for a net gain of 276 spots. However, code states that with 143 residential units, 214 spots must be reserved for the tenants. By law, 34 spots must be reserved for the 32 hotel units and 36 must be reserved for 9,000 square feet of commercial space. So, the number of parking spots required for the project is 284, which equates to a LOSS of eight spaces. This is a worst-case scenario, but depending on how you skew the numbers the number of newly-added, available and unallocated parking will be at best 20-25.

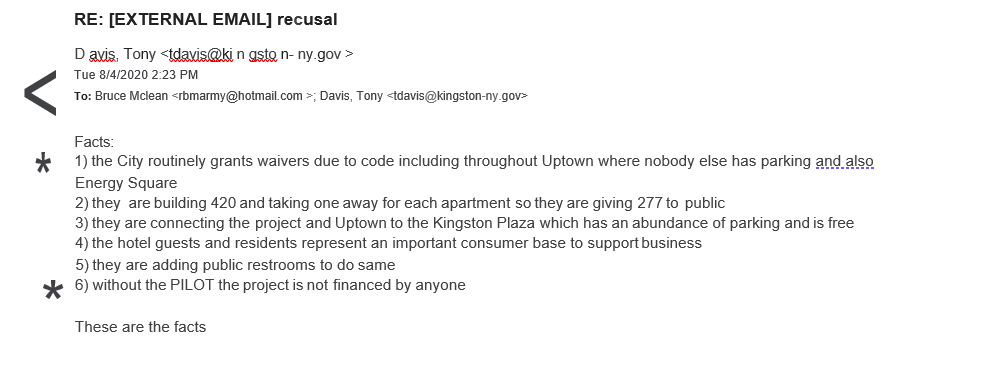

(5) When I asked my alderman [Tony Davis] to vote against the PILOT he emailed me back that “they cannot get the financing without the PILOT” and “since there is no parking uptown we had to give them a variance.“ Then, finally he and the developers admitted the overflow can park in the Plaza. Why are we agreeing to give up $30 million to park the overflow in the plaza, where they are parking now anyway? (See photo of email below and editor’s note at bottom of page.)

(6) School Board President James Shaughnessy spoke eloquently about the negative effect this PILOT would have on School District finances. A similar situation happened in Auburn, NY and it was devastating. Shaughnessy’s presentation can be found at 43:38 https://www.youtube.com/watch?v=U8DZHspUTgg

(7) Much has been written claiming that sales tax generated by the tenants, hotel, and commercial space will offset the loss of property tax. I have put together a narrative effective as of October 21, and the calculations, verified by two CPAs, are mind boggling. (SEE EXHIBIT B)

(8) The number of jobs to be created varies much like the number of new parking spaces. There will be temporary construction jobs, but from my conversations with builders and contractors it is already difficult to find people in what has become an area with a limited tradesman type work force. I also believe the number of permanent, well-paying jobs to be created is far less than even the lowest of expectations.

(9) As for Planning Board approval, that train appears to have left the station, but as a former member I am familiar with the tricks employed to fast track or delay a project. I believe the drawings distort the true size of the building. Eliminating Fair Street is a questionable decision. The stress on infrastructure may very well be underestimated. The need for “desperately needed” parking may also be exaggerated, judging from my recent trips to the area, and that is even with the removal of parking spots now repurposed for outside dining. Moreover, the two active lawsuits being litigated in State Supreme Court may negate the project in its present form. Certainly, it would seem to be premature to approve a project or PILOT until the lawsuits are settled, and I find it hard to conceive that the lenders would move forward with the legal dark cloud overhead.

We now are all aware of the Yosman Tower/Gov. Clinton PILOT that deprived the School District of millions. Please do not let history repeat itself.

The choice is simple: A parking garage for at most a few dozen more cars, with education funds available for babies born in the distant future. But do not ask about this generation of Kingston’s children, because in 25 years they will be gone

EXHIBIT B

If the Kingstonian is assessed at $19 million, at the present city non homestead tax rate of $15.61 per thousand, the property taxes flowing to the City of Kingston alone would be $296,590. This means that for sales tax of 8% to generate $296,590, you would need sales of $3,707,375. But wait, the City only gets 11% of sales tax generated throughout the county, so in reality, $33,366,375 would be required to generate $2,669,590 in sales tax of which the City would get 11% or $293,625, (rounded up). But wait: the state gets 50% of the 8%, so in essence you’d need new taxable sales of $66,732,750 to compensate for the lost City real property taxes of $293,590 rounded.

-0-

Editor’s Note: The developers have never offered proof that without the PILOT they cannot secure financing. Originally they said they could not afford to include affordable housing, and yet, they did so in response to public pressure, although those 14 units are available only to a narrow segment of workers. The developers and the mayor also said a state grant of $10 million would be withdrawn if they didn’t receive the PILOT. But state officials in charge of the Downtown Revitalization Initiative have confirmed in writing that the award would be re-allocated to another project in Kingston. The developers have also remained silent on a projected sale price, yet they must sell by the end of 2047 and could net well over $200 million. In light of these inaccurate assertions and incomplete financial documents, it is prudent to question whether it is indeed true that no bank will finance the project in the absence of a PILOT.