$28 Million Tax Break for Valet Parking at Boutique Hotel

“Corruption is paid by the poor” — Pope Francis.

Background: The Kingstonian is a proposed $55 million high-end project consisting of 143 apartments, boutique hotel, garage and retail space to be built almost if not entirely at taxpayer expense. To be developed by Brad Jordan and his unidentified investors, who are rumored to include elected officials, the project is funded on the public dime to the tune of 60.15% through New York State grants and a property tax break that will deprive Kingston, Ulster County, and the Kingston School District of $28 million. Upon sale, the investors will pay no capital gains tax because the project lies within an Opportunity Zone and they will pocket around $100 million if they hold for ten years — not bad, considering their cash investment is $6 million.

Updated Jan. 26 to include information about privatization of parking.

Updated Oct. 1, 2022 to include loss of 42 spots.

Dec. 31, 2021

Kingston, NY – Anyone who shops at Kingston Plaza knows that owner Brad Jordan recently added new parking at the western edge of his mall near the Dutch Village apartment complex. These new spots, plus room at the other end of the mall for expansion, offer tantalizing clues to a problem that’s long been apparent: the Kingstonian garage would shrink the number of publicly available parking spaces.

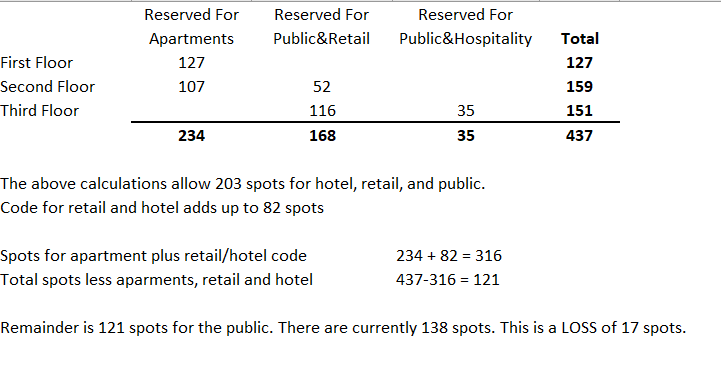

For the first time, plans recently uploaded to the City of Kingston’s website acknowledge that spaces reserved for the Kingstonian’s apartment dwellers, plus those required by code for its shops and hotel, will lower public parking by 17 spots when compared with the City-owned parking lot that’s there today. That’s right, a loss of 17 spots.

Update: On Sept. 19, 2022, the Kingston Planning Board met to discuss a draft resolution acknowledging that if code was followed, only 96 parking spots would be available to the public. The N. Front St. lot contains 140 spots, of which two are unusable, leaving 138. Subtract 96 spots, and you’re left with a loss of 42 spots.

Yet “desperately needed” additional parking was the raison d’être for the gigantic tax break developers said they needed to subsidize the money-losing garage. Will their tenants, hotel guests, and commercial real estate customers and employees need parking? Sure. But the garage has been dressed up as a benefit to residents who already live here, and it just isn’t so.

Q. With $28 million hanging in the balance, what’s a developer to do?

A. Divert cars that would normally park in the garage to nearby spaces you’ve just black-topped in the neighboring mall that you own. Hire valet parking attendants to drive those cars there, which also helps satisfy job creation requirements.

The developer and his supporters in local government have spun a multitude of yarns to justify the handout, with each and every argument so flimsy that not one withstands scrutiny. Fake Data, Fake Benefits examines economic fables. This piece examines the parking shell game.

Cover costs, or cover story

Joe Bonura Jr., who was the original partner, maintained the garage was the only reason he and Jordan were asking for a tax break. “If there was no parking garage, if there was no parking structure, we wouldn’t need a PILOT,” he told the IDA in July 2020. At the time, he said the garage would offer 277 spots for the public. Even the IDA, enthusiastic toadies that they are, didn’t fall for the math. (See this time-stamped, annotated and lightly edited transcript including the reference to valet parking and this video.)

For another whopper, here’s Planning Board Chair Wayne Platte asking about the parking in June 2019, and Kingstonian engineer Dennis Larios replying that 290 spaces would be available to the public, which in this case was specifically defined as people whose presence was unrelated to the Kingstonian.

Supporters say parking is “desperately needed.” Is this even true?

Probably not. Parking is “universally oversupplied,” according to this study reported in Bloomberg, including in “areas that believed parking to be scarce.” Clues abound that Uptown Kingston is no different, that the developers and government knew so all along, and that the issue is merely a fig leaf to justify the tax giveaway.

At the IDA presentation, Bonura pinpointed the real reason for Kingston’s Uptown parking problem: people who work Uptown hog the meters. “They stay in the same spot all day and then a consumer has a hard time getting in and out of that business,’ he told the IDA. “The goal for most of the parking is to get the employees that work Uptown to park in the garage.”

Solutions that won’t cost taxpayers tens of millions include enforcing time limits in narrow, historical streets so that employees park elsewhere, or improving public transportation, the way real tourist destinations do. Take the Old Town area of Nice, France, which is pedestrian only. Colonial Williamsburg provides a free shuttle. Do our elected officials want 21st century mall and garage creep, with chain stores inching closer to our Revolutionary-era stone Senate, or do we want to honor Kingston for its true patrimony?

While Bonura accurately identified the meter-hogging, he, Jordan and Mayor Steve Noble also served up a smorgasbord of bad alibis for the tax break.

Most creative pretext to build garage. People park in Jordan’s mall when they “don’t have business” in the plaza, said Noble. The mall hasn’t “managed to keep out people really from parking there maybe when they shouldn’t or don’t have business in the plaza. And so we believe a lot of the need is actually being filled by that right now, and will continue to be and so we know that we need more parking.”

Golly gee, can you think of solutions to this “problem” that won’t cost $28 million? And doesn’t it mean we’re paying Brad Jordan $28 million to not have cars in his mall that “don’t have business” there? How will the garage keep those “business-free” cars out of the mall? And honestly, given that the mall’s not really close to much, how likely is it that the “problem” contains even a shred of truth?

IDA Chair James Malcolm’s post-5 o’clock sidewalk roll-up. “I was up in Rochester one night for a meeting and basically it seemed like the sidewalks were rolled up at five, six o’clock at night. So the beauty of the Uptown and the Stockade district is you know, you can walk around, you can park central and then you can walk around a little bit and you know, that’s a linchpin to create economic development there as well.” This paired well with Noble’s complaint that “at five o’clock everybody leaves from the county office building and nobody’s open anymore.”

Retirees need housing in the higher range. “There’s almost no place” for retirees, Noble told the IDA. “If they’re paying a mortgage, they’re paying about $2,000 plus dollars a month. Many of the tax bills are somewhere between $8-10,000 a year… And so you take that and you turn that into rental payments, you know you’re pretty close to that $1,800-2,000 a month. [Ed. note: Actually, you’re pretty close to $2,800 a month.] And so we’ve already had lots of folks reach out to my office, say, I want to retire in Kingston… and there’s no housing in that higher range for me.”

Jordan’s mall tenants need more customers, specifically 300 consumers eating breakfast lunch and dinner. “If you go to the Uptown business community or KUBA (Kingston Uptown Business Association), the business owners and the plaza tenants, you need the consumers as much as you need parking,” Jordan told the IDA. “So I would argue that 300 consumers that are going to be eating breakfast, lunch and dinner every day are as important now more than they were in the beginning when we were trying to address the parking issue.”

Apart from Noble’s ludicrous complaint about cars with no business parking in Jordan’s mall, these arguments call for increased consumer spending and housing, not parking spots. In fact, final approval for the tax break came when County Executive Patrick Ryan based his opinion on a 1985 NYS Comptroller’s opinion that tax breaks for housing were allowed if it is a “commercial activity within the meaning of the IDA Act” — an opinion so circular and loosely defined that it would justify a tax break for the proverbial ham sandwich. (New York State chief judge Sol Wachtler famously said district attorneys could get grand juries to “indict a ham sandwich, if that’s what you wanted.”) Is it 300 new customers eating breakfast, lunch and dinner? Is it more business for Brad and his tenants? Is it the new valets? Or is it those pesky cars that park in the mall, stealing time and space from Brad when they have no business there?

Privatization of profit, socialization of loss. Even if Kingston could use 300 new tenants, does it justify the damage, direct and indirect, caused by extracting this much money from the commonwealth and sending it into a private pocket? Appearing on Shayne Gallo’s Speakout show Jan. 1, 2022 on Radio Kingston, KingstonCitizens.org founder Rebecca Martin said, “I do have concerns always about privatization of any public asset, water, whatever, parking, etc. You’re at the mercy of whatever the going market rate is, and so whatever you’re being told, likely it will be different.”

Currently, a year’s permit in the City-owned lot costs $100. The developers have said monthly costs for tenants in the affordable units will be $60 a month, for an annual cost of $720. Here’s what happened in Chicago when the garages were privatized.

More fallacies. Proponents have argued that if the developers don’t receive the tax break, the City of Kingston would have to spend the same amount to build a garage. Really? A recent midday Thursday visit found the parking lot about half full, and there were empty spots on all the Uptown streets I drove through, including Kingston’s Gold Coast of Wall St. between John and North Front. Moreover, in the unlikely event the City did build a garage, the price would be much lower. According to various online garage cost calculators, including this site, the average cost to build a parking garage is around $9 million for a high end, 420-spot garage sized, according to this site, at 145,000 square feet.

The other fallacy is that nothing will be built on that spot if the Kingstonian doesn’t go through. When Jordan and Bonura first started talking, they were discussing only Jordan’s property, not the City-owned lot. Economists have found that many tax breaks are given to projects that would have been built anyway.

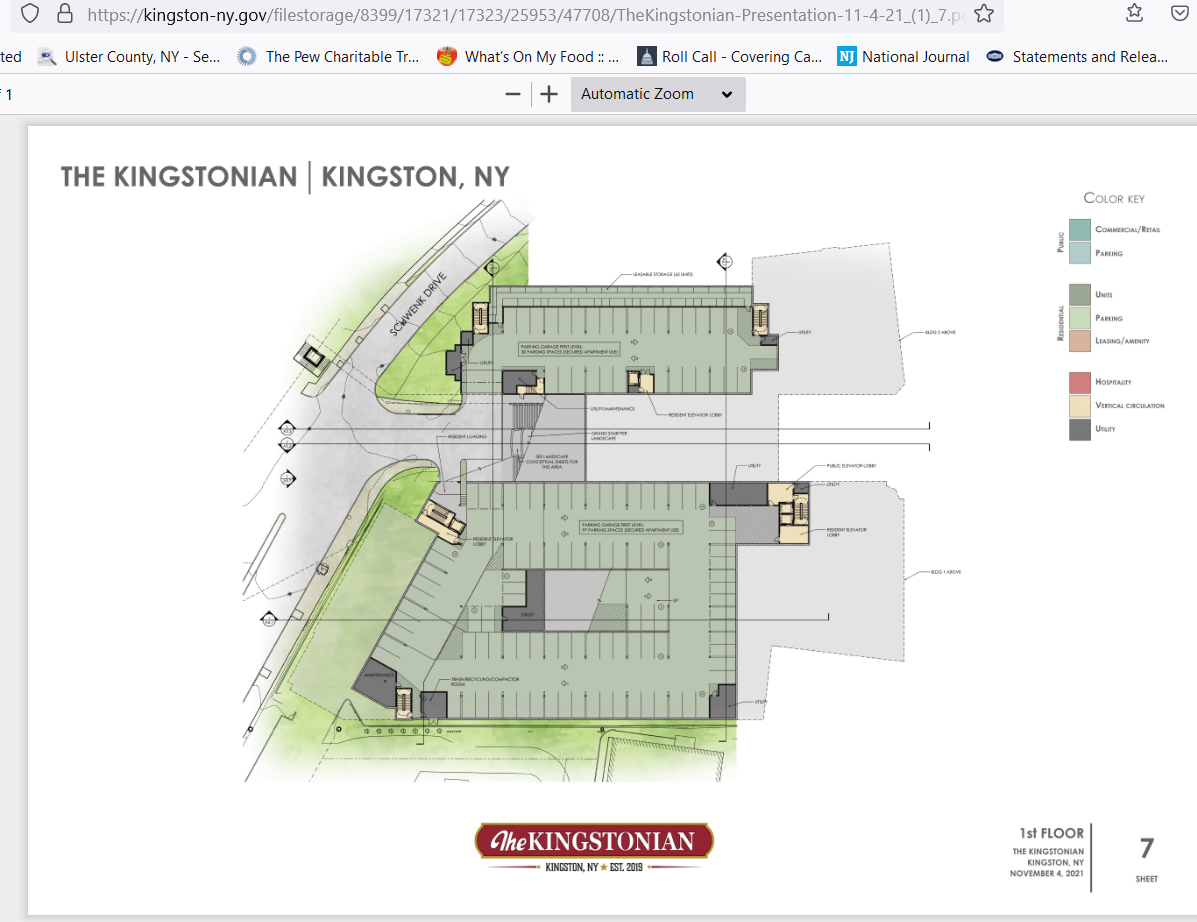

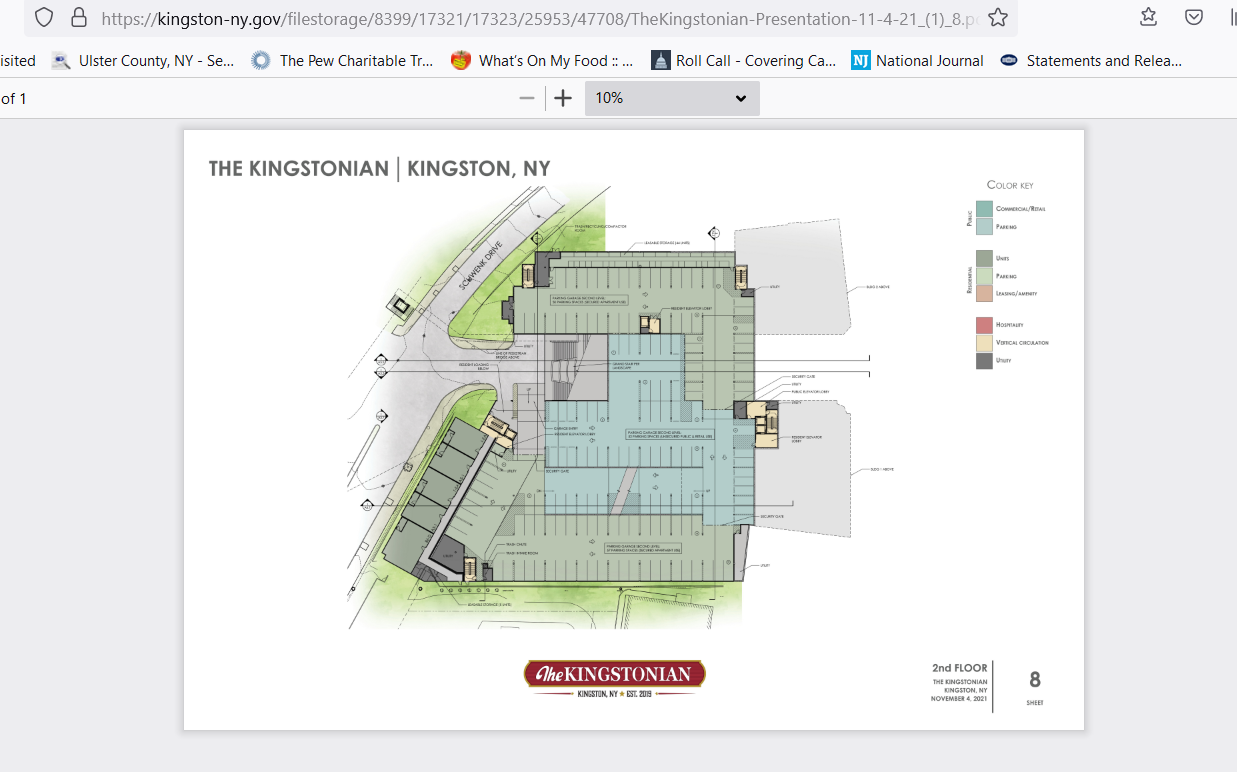

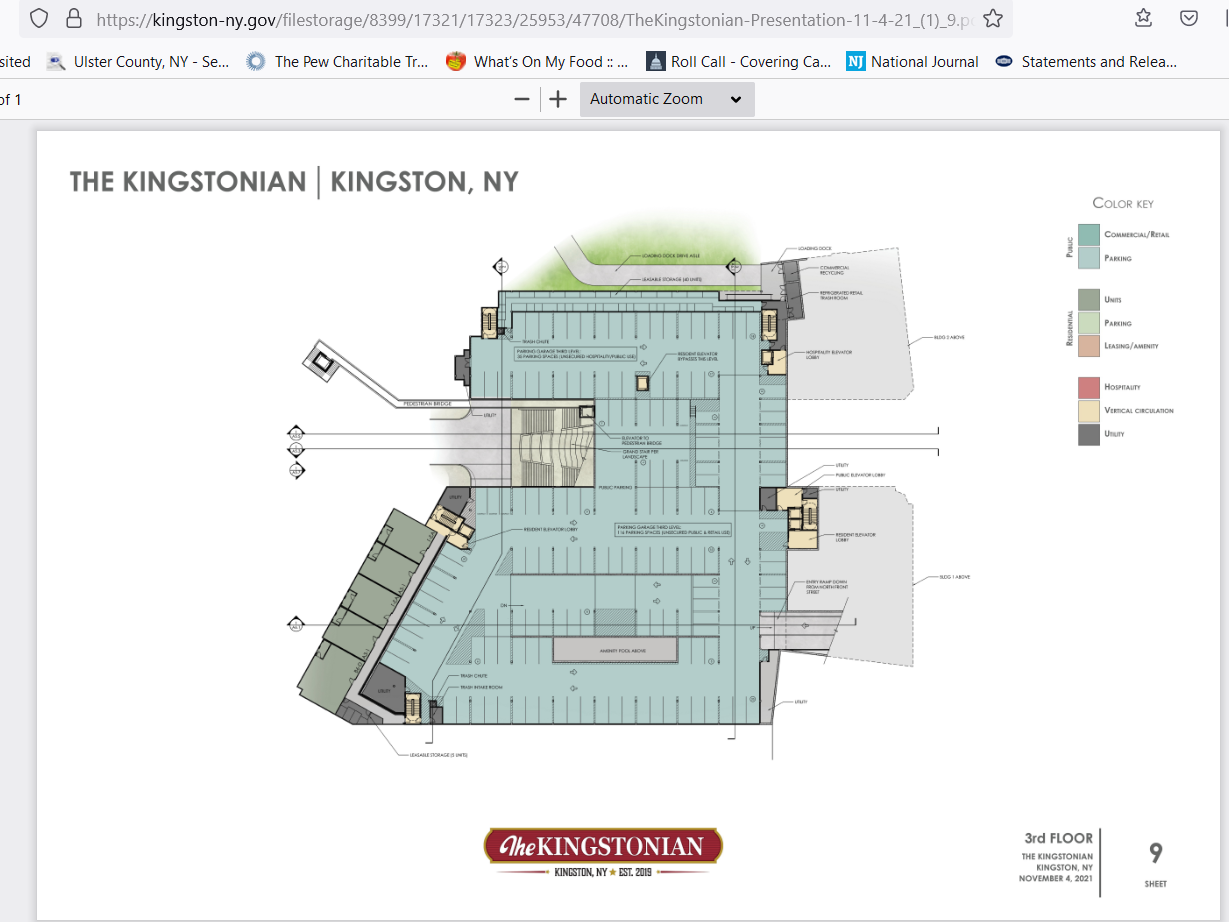

New plans. When architect Scott Dutton came on board, he increased the number of spots in the proposed garage to 437, up from the previous 420. And yet, despite the new spots, if code for the shops and hotel is followed, the plans make only 121 spaces available for the public — a loss of 17 spots from the 138 in the existing City-owned lot today.

To zoom in for a bigger view, click on the plan.

Spots in garage

First Floor

Second Floor

Third Floor

It was not clear whether Jordan would receive his mall-based parking spot exemption from code through a waiver from the Planning Board, a variance from the Zoning Board of Appeals, or by taking advantage of a section in the City code that allows for shared parking between adjacent lots.

The City has never made it easy to find what they don’t really want you to see. For the new plans, follow these steps:

- https://kingston-ny.gov/

- From the “Popular Links” menu on the left, click on “Documents & Forms”

- From the “Government & Services” menu on the left, click on Planning Projects

- A submenu will open, and click on Planning Board

- A list of planning projects will open on the right; click on the dropdown menu entitled “Make Your Selection” and scroll down to and click on “The Kingstonian”

- Click on the sub-dropdown menu entitled “Choose from the following” and scroll down to and click on “HPLC_HAC Submission 12_2_21 – Revised architectural”

- A list of 20 documents will open for you to click on individually.

-0-