Gain for Developers Spells Pain for the Children of Kingston

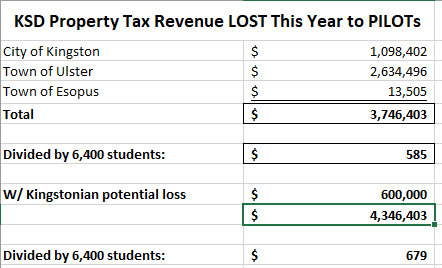

KSD To Forgo $4,347,000 this year to PILOTs if Kingstonian giveaway is approved.

Nov. 27, 2020

Kingston, NY – The Kingston School District is losing $3,746,403 this year to tax breaks known as Payment-in-Lieu-of-Taxes (PILOTs) — and if the Kingstonian PILOT is approved, the total will rise to $4,347,000. That would be almost $680 for each student.

The Kingstonian is a proposed $60 million development consisting of 143 apartments, boutique hotel, garage and retail space. Once built, it would be assessed using an income valuation method at $19 million. Instead of the full property tax bill of $932,000 on that $19 million assessed value, the developers have offered to pay $40,000 a year – a difference of $892,000, of which a hair under $600,000 would have gone to the school district.

The payments would rise every year, with percentage increases of 3% or 4%, depending on the offer.

According to the St. Louis Fed, multifamilies double in price about every ten years. Using the rule of 72, that translates into roughly a 7% annual increase – yet the developers are offering the taxing jurisdictions a much small annual increase on a base payment that itself is minuscule compared with the normal property tax.

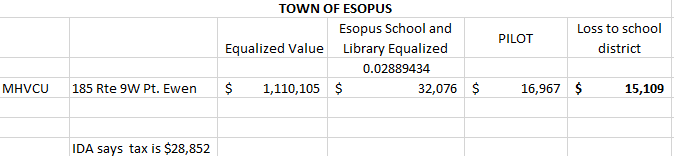

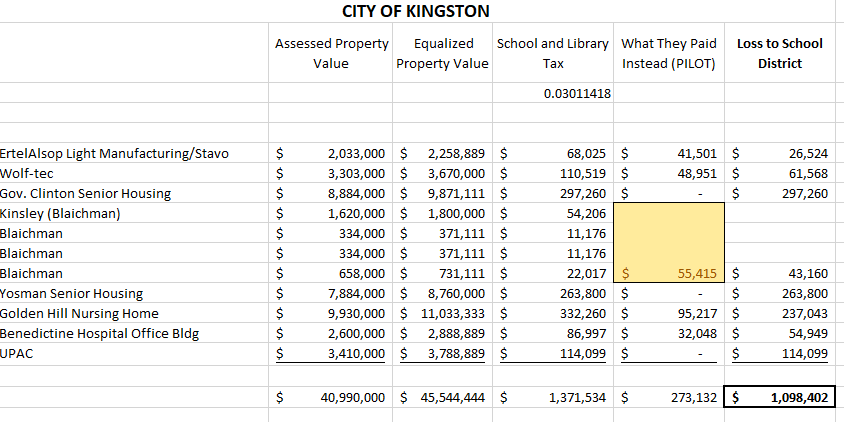

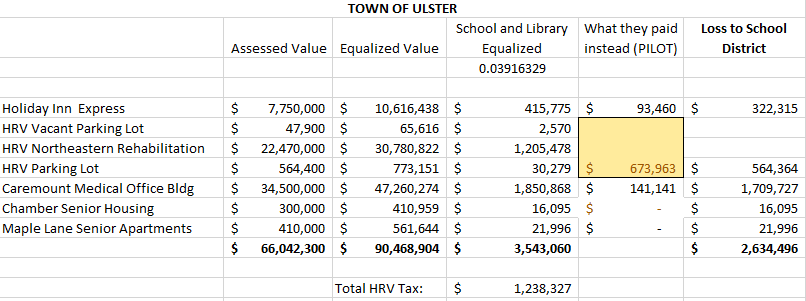

The charts below only list PILOTs that cause the Kingston School District to forgo revenue. Other tax breaks exist, but they are not listed here. These figures were compiled from tax rolls and documents from the school district as well as the Ulster County Industrial Development Agency. The numbers did not always agree, and it was unclear whether that was because of clerical error or a failure on The Vindicator’s part to grasp the complexity of local tax policy.

PILOTs appear to have quadrupled in the past decade. Compare today’s numbers with those from 2013, on p.6, when the KSD forwent less than a million dollars in this flavor of tax break.

While the Kingston School District reaches into many townships, only three jurisdictions contain PILOTs: the Town of Esopus, the Town of Ulster, and the City of Kingston.

Economists say tax breaks are often unnecessary because the projects would have gone forward anyway. It is reasonable to ask why health care establishments in the Town of Ulster have been the recipient of the Ulster County IDA’s largesse; given the presence of the hospitals in Kingston, the ToU makes perfect sense with or without a PILOT.

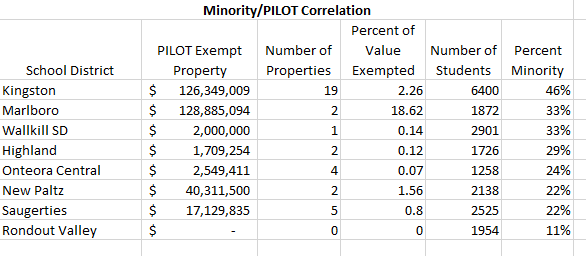

The last chart looks at the correlation between PILOTs and minority enrollment in school districts in Ulster County. The correlation is not perfect, but it is there. Of course, correlation does not equal causation, but the link bears further investigation. Evidence is stronger from GoodJobsFirst, which says the answer is unequivocally yes.

And if you’ve wondered what happens to education in general as a result of “economic development” tax breaks, read this.

You decide: An air-conditioned garage, or future generations?